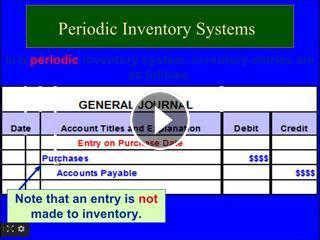

Financial Accounting online Tutorial 7 | Periodic Inventory System , JIT, FOB, Gross Profit method, Inventory turn over rate, LIFO, FIFO, Specific Identification, Average inventory calculation.

What are the effects of overstating inventory?

If a corporation overstates its inventory, it will also be overstating its gross profit and net income as well as its current assets, total assets, retained earnings, stockholders' equity, and all of the related financial ratios.

The gross profit and net income are overstated as a result of overstating inventory because not enough of the cost of goods available is being charged to the cost of goods sold. The higher amount of net income means that the reported amount of retained earnings and stockholders' equity is also too high.

Since the overstated amount of inventory at the end of one accounting period becomes the beginning inventory of the following period, the following period's cost of goods sold will be too high and will result in the period's gross profit and net income being too low. (The retained earnings and other balance sheet amounts will be correct at the end of the second period.)

What are the effects of overstating inventory?

If a corporation overstates its inventory, it will also be overstating its gross profit and net income as well as its current assets, total assets, retained earnings, stockholders' equity, and all of the related financial ratios.

The gross profit and net income are overstated as a result of overstating inventory because not enough of the cost of goods available is being charged to the cost of goods sold. The higher amount of net income means that the reported amount of retained earnings and stockholders' equity is also too high.

Since the overstated amount of inventory at the end of one accounting period becomes the beginning inventory of the following period, the following period's cost of goods sold will be too high and will result in the period's gross profit and net income being too low. (The retained earnings and other balance sheet amounts will be correct at the end of the second period.)

Comments